Previously: Same old spot market or 'totally different world'?

Owner-operators in trucking generally have two options when it comes to sourcing freight -- brokers on the spot market or directly from the source, the shipper.

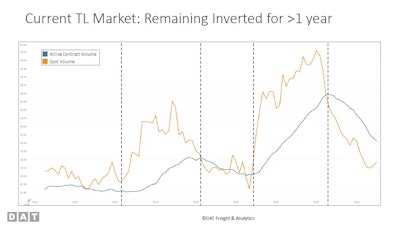

As any trucker with relatively recent experience with spot freight knows, the highs of working the load boards can be really high, as seen from late 2020 through early 2022. On the other side of that coin, however, when the market flips in favor of shippers like it has for the last 18 months or so, it can be tough to keep your business afloat.

This chart compares average dry van contract rates from shippers with average brokered spot rates over the current and last four cycles as judged by DAT Chief Scientist and MIT professor Chris Caplice, dating back to 2015. It shows just how far and fast spot rates can fall when the tide turns. Since the most recent high near the beginning of 2022, average dry van rates have lost more than $1.20/mile. Contract rates' average is down, too, but not nearly as far.

This chart compares average dry van contract rates from shippers with average brokered spot rates over the current and last four cycles as judged by DAT Chief Scientist and MIT professor Chris Caplice, dating back to 2015. It shows just how far and fast spot rates can fall when the tide turns. Since the most recent high near the beginning of 2022, average dry van rates have lost more than $1.20/mile. Contract rates' average is down, too, but not nearly as far.

Through the end of June, trucking has seen a net loss of more than 12,500 active for-hire carriers, according to a recent analysis of Federal Motor Carrier Safety Administration data by C.H. Robinson. The report noted that about 80% of authorities revoked this year were those of one-truck carriers, with the balance mostly being small, multiunit fleets.

The market boom in 2020 and 2021 enticed more drivers to strike out on their own to become owner-operators, many with authority, and allowed current owners the revenues and opportunity to bring on more trucks, accounting for much of the growth in trucking over the period. When the market turned in shippers' favor, though, many operations relying heavily on the spot market just weren't in a position to weather the storm.