Previously: Direct freight: Delivering a modicum of consistency in a turbulent market

Justin (left) and Brandon Borchers started their Borchers Brothers Trucking business to go along with their Nebraska-based Borchers Ag farming operation in 2013. Working on the farming side for Monsanto (now Bayer) since 2000, they were able to establish direct shipper freight at the very beginning of their business.

Justin (left) and Brandon Borchers started their Borchers Brothers Trucking business to go along with their Nebraska-based Borchers Ag farming operation in 2013. Working on the farming side for Monsanto (now Bayer) since 2000, they were able to establish direct shipper freight at the very beginning of their business.

Justin Borchers said the trucking side of their business started as a way to keep a good farm hand happy. The hand wanted to get into trucking, so the Borchers went to their main farm customer, known as Monsanto at the time (in 2016 Bayer bought the company). They'd farmed for Monsanto for since 2000.

They talked about getting a truck on for seed harvest, which is just for the month of September, then hauled direct for Monsanto through the winter months that first year. The next year, they went full-time hauling direct for them year-round. They did that with just one truck for two or three years before adding a second truck, as long as they could get in for the seed harvest in September.

After some negotiation, the second truck got on the list -- primarily because they were also going to run it dedicated year-round, too. A couple years later, they added a third truck to do the same.

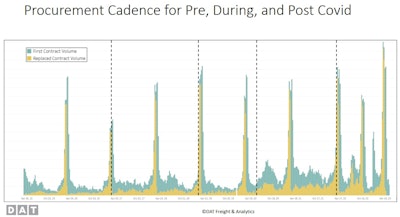

There's evidence more large shippers are recognizing the value the smallest carriers bring to their operations, as the Borchers' example illustrates. Speaking as part of a Journal of Commerce panel webcast last week, DAT Chief Scientist and MIT professor Chris Caplice presented data that showed the rhythm of new rates coming into the contract market. In the past, even the very recent past, annual requests for proposals (RFPs) were the most common bidding processes for carriers working with large customers, as evidenced in the chart below.

Since the COVID-19 pandemic's strambling of freight relationships in 2020, shipper processes have in some ways loosened up, with opportunity for small carriers. Post-COVID, the rule has been less the annually conducted bid but rather new contracting opportunity semi-annually, quarterly or at less formal, shorter intervals throughout the year.

Since the COVID-19 pandemic's strambling of freight relationships in 2020, shipper processes have in some ways loosened up, with opportunity for small carriers. Post-COVID, the rule has been less the annually conducted bid but rather new contracting opportunity semi-annually, quarterly or at less formal, shorter intervals throughout the year.