The debate around broker transparency over the past year has veered into squabbles over freight rates and broker margins, as well as the history of deregulation and freight brokerage writ large, but is boosting rates even the point of the proposed regulation?

On one side, truckers such as Dakota Springfields, who successfully got the Federal Motor Carrier Safety Administration to retrieve and provide her the documentation around a load moved for TQL (revealing, she noted, a whopping 44% margin for the broker), assert that transparency will reveal widespread lying and cover-ups from brokerages. So far, the vast majority of respondents to Overdrive's own recent survey on FMCSA's November-proposed transparency regs changes (79%), too, predict a positive impact emerging for rates as an outcome. (Take the brief two-question survey at this link if you haven't as yet.)

[Related: Broker margins, rates data, transparency: What owner-operators really think]

On the other side, brokers and some freight market watchers assert that broker margins, certifiably (through audited earnings reports from publicly traded companies and other sources), do come out to just around 15% or so on average, and that transparency won't change the underlying supply and demand dynamics that drive pricing. Some brokers and carriers alike, if they predict a rates impact at all from FMCSA's proposal, see a solid negative -- 11% of our survey respondents so far have flagged a "race to the bottom" as the likely result for rates.

Yet with all the focus on rates and margins, something gets lost.

Regarding the proposed changes to 49 CFR 371.3, which currently entitles a carrier to see the rate a shipper paid for a load they hauled, among other things, DAT Chief of Analytics Ken Adamo doesn't really get what all the hubbub is over. "I'm confident that this rule, which allows for access to historical settled rates, will have insignificant [impact] on settled rates in the future," he said. "I do think it makes it easier for carriers to access this information from brokers." Yet "to do what with, I'm not sure."

In the FMCSA's recent notice of proposed rulemaking (NPRM), the agency said it believes market factors, and not the availability of the information transparency will provide, “are likely more dominant in setting freight rates. However, the agency has not ruled out the possibility that motor carriers and shippers could negotiate for better rates over time using the broker transparency information.”

[Related: Transparency: FMCSA proposes 'regulatory obligation' for brokers]

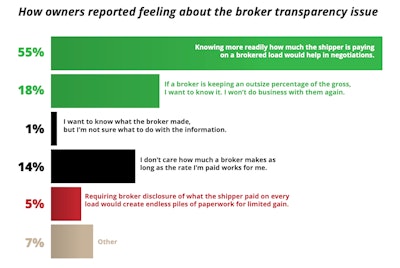

In short, the broker transparency NPRM isn't about changing freight rates. Some smart carriers might use the revelations gleaned from transaction records to negotiate better rates on future loads, but many will likely not. Others still will find it unhelpful. In Overdrive polling earlier this year, 55% of respondents said "knowing more readily how much the shipper is paying on a brokered load would help in negotiations."

Fourteen percent said they didn't care one way or another "how much a broker makes as long as the rate I’m paid works for me," illustrating a diverse set of opinions among carriers toward transparency.

The Owner-Operator Independent Drivers Association, in its original 2020 petition to FMCSA requesting changes to strengthen transaction-records disclosures, does mention low rates. But the association doesn't assert transparency would boost rates. Rather, OOIDA takes the position that it's about brokers playing by the rules and observing the regulations on the books. OOIDA called for FMCSA to block brokers from requiring carriers to waive their right to broker transparency in contracts, also calling out brokers for making records inaccessible in other ways.

"In effect, brokers are exempting themselves from federal regulations," wrote OOIDA in 2020. "Small-business truckers would never get away with blatantly and deliberately evading federal regulations, nor should they. Accordingly, 49 CFR §371.3 must be amended to prohibit brokers from including any provisions in their contracts that require a carrier to waive their rights to access transaction records."

Overdrive asked OOIDA directly if it thought enforcement of 371.3 would move the needle on rates.

"Rates are determined by supply and demand in the freight market," an OOIDA spokesperson said. "However, FMCSA’s lack of enforcement of broker transparency regulations that are currently on the books has resulted in a one-sided asymmetry of information in the freight market to the exclusive benefit of freight brokers."

FMCSA seems to agree with OOIDA here, not just by advancing their petition to the rulemaking process, but also directly referencing the "asymmetry of information" under the "Purpose and Summary of the Regulatory Action" section of the NPRM. Here's what FMCSA says the goal of its new rule is, emphasis mine.

Property brokers match motor carriers with shippers, which can create new business opportunities for motor carriers and transportation solutions for shippers. This business model can also lead to an asymmetry of information between parties, which in turn can affect the contracting process by limiting parties’ ability to negotiate for their desired terms.

These risks can lead to market inefficiencies, such as decreased freight capacity or decreased market competition, which can arise when parties lack material information about the transaction. FMCSA and its predecessor agencies have attempted to address these problems by requiring property brokers to keep certain records of their transactions and make the records available to motor carriers and shippers involved in those transactions. Making the records available to the transacting parties, sometimes referred to as “broker transparency,” is meant to inform business decisions and enable self-policing of abuses that may arise.

In short, FMCSA says it's unfair that brokers know practically everything about a load and carriers know only what brokers tell them, and they seek to correct that by strengthening 371.3. Notice in the NPRM excerpt the lack of emphasis on anything to do with freight rates.

The agency's broker transparency push is probably better understood as transparency for transparency's sake, a way to give carriers a clear window on claims, chargebacks on loads and the like, not an effort to influence rates industry-wide. FMCSA in the NPRM says "the reduction in information asymmetry due to increased transparency should enable a more efficient market by reducing chargeback abuses."

Keeping brokers honest, basically, is the goal. If a shipper pays detention to a broker and the carrier doesn't get it, or if the broker says there was a claim on the load when there was not, this opens up a window for carriers into an otherwise opaque transaction.

[Related: Trump II and the outlook for speed limiters, broker transparency, parking push]

"When all parties to a transaction have access to information that is legally required, it lays the groundwork for a fair negotiation," said the OOIDA spokesperson.

Really, the current broker transparency push might be best understood as a "carrier rights" issue. For decades, carriers have had the "right to review" brokered freight transactions -- the change proposal seeks to narrowly clarify the "regulatory obligation" brokers have to provide that transparency, on the other side of the many barriers freight middlemen erected through the years.

"We’re not suggesting that broker transparency will set rates or guarantee certain rates," said the OOIDA spokesperson. "We support the free market and are trying to even the playing field so that truckers aren’t negotiating with one hand behind their backs."