New research into the availability of truck parking at state-owned facilities -- primarily rest areas -- revealed that only a few states have acquired or looked to acquire land or right-of-way for new truck parking over the last decade.

The research comes from the American Transportation Research Institute, which worked with the American Association of State Highway and Transportation Officials (AASHTO), representing the 50 state Departments of Transportation, Washington, D.C. and Puerto Rico, to gather data from states.

Though truck parking has been nothing if not one of the most high-profile issues for trucking writ large for at least a decade and a half, of the 47 states that provided data for the ATRI study, just 1 in 4 indicated acquiring or working to acquire land for truck parking in the last 10 years. States cited a lack of funding (36%), community pushback (27%), and difficulty locating suitable land (25%) among the biggest challenge to land acquisition.

The high-profile nature of the parking issue shows through in the majority of states (64%) that indicated they've considered the potential of truck parking additions to existing state-owned facilities outside traditional rest areas, including weigh stations, park-and-ride lots, and closed welcome centers. Weigh stations were the most-commonly-cited facility by states who've made moves in that direction.

While such a strategy provides an immediate response to truck parking demand and avoids long design and construction timelines, along with higher costs, restrictions and stipulations on weigh-station parking varied widely. In Georgia, access is continuous and unrestricted, yet in Louisiana, access is provisional only after prior approval and arrangements. ATRI noted that Georgia has nearly as many truck parking spaces at weigh stations (704) as it does at rest areas (997).

Truckers are apprehensive about parking at weigh stations, of course, a fact ATRI noted in its report, given an increased likelihood of inspection -- or the perception of such. When it comes the perennial issue of concern for truckers that is parking, though, every little bit helps. Despite the challenges of procurement of new land, ATRI's study found states and the federal government increasing their own level to the issue.

“Truck drivers are going to be our best voice for pushing this information,” ATRI Senior Vice President Dan Murray said, urging drivers to use the report's data to provide “strategies and solutions” to their own states and cities, “advocate for more truck parking at existing rest stops, advocate for more truck parking at non-rest areas."

[Related: How to fight for your right to park the truck]

Low-hanging fruit for public truck parking space

The research included a joint ATRI/AASHTO survey of the 50 state DOTs to understand the costs and components of state provision of public truck parking spaces. Within the 47 states that responded to the survey, 1,598 of a total of 1,784 rest areas (90%) have at least one truck parking space.

ATRI used findings from the state DOT survey to generate a public truck parking index dashboard that features each state’s reported public truck parking capacity and the breadth of amenities and safety features at rest areas. The metrics evaluated in the dashboard consider differences in state size, road mileage and proximity to major freight routes.

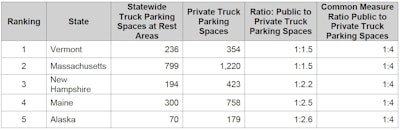

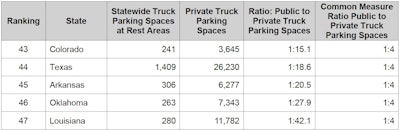

ATRI also took into account the level of private truck parking in each state and compared that to public availability. Though it varies considerably by region and land availability/expense, a common measure is for 20% of truck parking spaces in a state to be provided by the public sector, and 80% from the private sector, or a 1:4 ratio. ATRI presented five states with the highest public to private parking ratio (the first graph below), likewise five states “with the greatest opportunity for public truck parking expansion” (the second graph):

ATRI

ATRI

ATRI

ATRI

Nationally, the average rest area has just 19 truck parking spaces. Regionally, Southern states have the highest average number of parking spaces per rest area, while Northeastern state rest areas have the lowest, given generally fewer National Highway System (NHS) miles there and less acquirable land. States in the South have an average of 25 spaces per rest area, while states in the Northeast have an average 15.

In other regions, reasons for lower average are less clear than in the Northeast. “Despite having fewer truck parking spaces per rest areas than states in the Southern region, states in the Midwestern region have a higher median total miles of NHS roadway,” the organization noted.

Common community concerns -- also known as NIMBY, or “not-in-my-backyard," views -- include perceived adverse environmental impacts of parking facilities as well as a disbelief that the proposed benefits of constructing the truck parking outweigh the fiscal cost: an average $113,395 per parking space, according to the report, yet with plenty variation depending on materials used and the like.

States primarily fund truck parking expansion projects through a combination of federal and state funds (41%), with some states using only state-level funds (36%), and others using only federal funds (23%). Nearly $752 million has been awarded to truck parking projects slated for years 2022-'26, the study found, from three federal grant programs. That sum will ultimately result in the construction of more than 2,000 spaces and additional parking improvements, including the development of a multi-state truck parking information system (TPIMS) project to deliver parking availability information to drivers in Washington, Oregon and California.

Truckers have likely run across these systems in a number of states, with signage along interstates informing drivers of the number of available spaces at an upcoming rest area. ATRI found nearly every state either has an existing system in place or plans to develop one in the near future.

ATRI surveyed truck drivers about their experiences with TPIMS, finding that only about a third of drivers (34%) have used the signs to find parking themselves, despite more than half (52%) having seen them. As also detailed in prior research and reporting, key concerns among drivers is the reliability of parking information delivered.

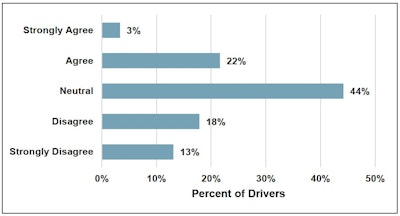

Across all states, the most frequently-held view of the reliability of TPIMS is neutral, with 44% of drivers selecting that option. Experience with TPIMS is mixed, with 31% of drivers not viewing it as a dependable source for truck parking availability, and 25% viewing it as reliable. Note responses below to the question of accuracy.

[Related: Truck parking info delivery study points to key limitations -- accuracy, accessibility in-cab]

In its driver survey, ATRI asked truck drivers to respond with their opinion on the following statement: “There is Always Available Parking when TPIMS Indicates Availability." As shown, more drivers disagree to some degree than those who agree.ATRI

In its driver survey, ATRI asked truck drivers to respond with their opinion on the following statement: “There is Always Available Parking when TPIMS Indicates Availability." As shown, more drivers disagree to some degree than those who agree.ATRI

Murray hoped the research might help those in the trucking community spread the word on the necessity of good parking options with their reps, regional/local Metropolitan Planning Organizations and other public stakeholders. ATRI may have thousands of good contacts all around the country, “but we’re the researchers," Murray said. "We’re not the guys and gals sitting behind the wheel, suffering, being forced into fatigued situations, being forced out of locations because maybe there’s only a four- or six-hour limit. We really need the truck drivers and the motor carriers to take this research and distribute it far and wide to the decisionmakers who we then hope will act on it.”

There's legislation currently on the table, at least, to direct more money at the problem of parking. Without truckers' engagement on the issue, though, there's certainly a likelihood it's misspent.