Previously in this series: How to vet brokers’ credit before taking a load

If you’re unlucky enough to get involved with a company and payment is delayed, TBS Factoring Service President Jennifer Licktieg says, it can make sense to go to a factoring company to collect. Brokers’ fear of being put on their do-not-factor list could well pry loose the money. “If they’re not going to get paid at all otherwise,” the percentage fee for the muscle a factoring company can bring to bear may well be worth it.

Factoring companies such as TBS “do report to the credit bureaus,” Licktieg adds, any instance of significant delays in payment, which could help another owner-operator down the line.

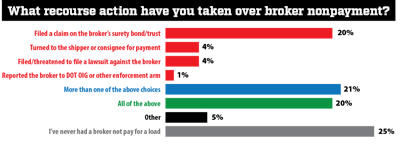

Three out of four owner-operators responding to polling this year reported at least a single instance of being stiffed by a broker and pursuing some recourse. When fraudulent intent is suspected, investigators advise reporting such incidents to the U.S. Department of Transportation’s Office of Inspector General, accessible via OIG.DOT.gov/hotline. (Click through the image for a larger version.)

Three out of four owner-operators responding to polling this year reported at least a single instance of being stiffed by a broker and pursuing some recourse. When fraudulent intent is suspected, investigators advise reporting such incidents to the U.S. Department of Transportation’s Office of Inspector General, accessible via OIG.DOT.gov/hotline. (Click through the image for a larger version.)Willie Taylor, director of assurance data management for Truckstop.com, encourages issues of nonpayment to be reported directly to his company via an online form, accessible via a “Report nonpayment” link near the bottom of the company’s main website, also accessible via this link. “Follow the money, and you can find the fraud,” Taylor says. “We work [those complaints] and investigate. If we find it’s true and the contracts are signed, we do try to mediate and get the carrier paid.”

DAT specifies a process for board users and others to report instances of nonpayment and other questionable practices via its “Report a Bad Player” form.

Taylor says that Truckstop.com also gets reports of nonpayment for Truck Ordered Not Used (TONU) fees or detention fees that aren’t specified in the carrier’s contract with the broker. “We can’t do anything about that,” he says. Get those items in the contract up front.

Taylor adds that “If we see a customer who triggers a lot of complaints very quickly, they get escalated” to the company’s security department for further action.

Load board security staffs take broker fraud seriously — but also with a little levity in the case of Truckstop.com and this toy chipmunk in a police outfit, says the company’s Willie Taylor. “Some bad guys do get caught. We’ll see them get captured, and my team has a little party every time we see one of those.” Chippy, as they’ve dubbed this little guy, gets passed to the Security Specialist of the Month. “He sings ‘Bad Boys,’ and he dances. They get a plaque and recognition for a Chippy Award.”

Load board security staffs take broker fraud seriously — but also with a little levity in the case of Truckstop.com and this toy chipmunk in a police outfit, says the company’s Willie Taylor. “Some bad guys do get caught. We’ll see them get captured, and my team has a little party every time we see one of those.” Chippy, as they’ve dubbed this little guy, gets passed to the Security Specialist of the Month. “He sings ‘Bad Boys,’ and he dances. They get a plaque and recognition for a Chippy Award.”If factoring isn’t working out, “You could give up 25% to 30% to a collection agency” to hound the broker for you, says Dave Carney of factoring company Nationwide Transport Finance. Or you could threaten to report nonpayment to a credit agency such as Ansonia or CompuNet, which could “taint the broker’s credit report.”

Small-fleet owner-operator Monte Wiederhold says he’s had two experiences of a serious issue of nonpayment by a broker over his long career. One he reported to Truckstop.com, with supporting documents, and “they checked it out and revoked the broker’s ability to post loads till I was paid in full, after about three days.”

The second serious issue involved a broker going out of business. The Owner-Operator Independent Drivers Association “helped me file on their bond,” and he “recovered every penny” owed, Wiederhold says.

OOIDA’s compliance services department also can be relied on by members for credit checks and other reconnaissance of brokers before the decision to do business, says association representative Norita Taylor.

WORK WITH A LAWYER

For owner-operator Rico Muhammad, the one time in recent years that he found himself moving a load with what he calls a “fly by night” broker, he had to employ the services of an attorney to write a letter to the broker to wring out payment. It’s a relatively easy option that might cost a little but can work in circumstances where payment times get out beyond contractual terms.

For such a letter, it can help to work through an association with some legal muscle, such as OOIDA. “They’ve got lawyers” on the payroll and experience writing legal letters to encourage broker payments, Carney says.

When that doesn’t work, though, taking a broker to court to force payment, or recoup an amount not covered by the broker’s surety provider, generally isn’t practical, given the expense and logistics of filing a lawsuit vs. the amount to be recovered. However, Carney adds, “At least with OOIDA, if a number of complaints from members come in” about a particular broker or surety, “they might be able to put together a class action suit.”

That was the case with Alliance Transportation‘s failure last decade, when Carney estimated in eventual court expert testimony that owner-operators were out more than $500,000 cumulatively. The class action, filed against the surety alleging failure to act promptly on claims, eventually was settled for an undisclosed six-figure sum.

Another hurdle in some potential lawsuits is that what’s legally considered a small claim must be filed “in the physical jurisdiction of the broker,” Carney says. “Filing out of state has no relevance. A carrier out of New Hampshire,” for instance, “suing a California broker — that doesn’t work” if the case isn’t filed in California.

FILE A WHISTLEBLOWER COMPLAINT

Investigatory resources also can be brought to bear in dealings where fraudulent intent is suspected, whether involving identity theft or a “hit it and move on” scam where a broker obtains federal authority with no intent to pay.

The U.S. Department of Transportation’s Office of Inspector General recommends owner-operators make use of its whistleblower hotline to report such matters: OIG.DOT.gov/hotline. There, you’ll find phone and email contacts (800-424-9071 and [email protected]), as well as an online form for detailing the complaint.

As the case of William Hickey, accessible via the link, makes clear, successful prosecutions have started with investigators at DOT OIG before being referred elsewhere, in that case to the Postal Inspection Service, with jurisdiction over mail and wire fraud. At once, though, owner-operator Debbie Desiderato’s attempts to report her own suspected case of a carrier identity theft hit roadblocks in the process, with OIG phone operators referring her back to FMCSA and the Federal Bureau of Investigation.

“Every avenue I took was a dead end,” she felt, though an FMCSA rep ultimately did “reluctantly take my statement.”

Her case turned out to be one merely of mistaken identity, not fraud, of course, as detailed in that story. Nonetheless, reps from OIG insist their whistleblower hotline operators are the right contacts for reporting such issues.

Next in this series: How to file on a broker’s surety bond