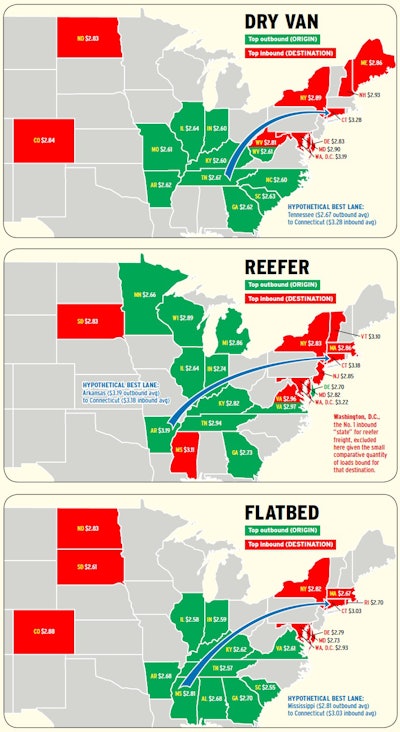

Owner-operator Joe Bielucki averages about $3.50 a mile on all miles, loaded or not, in the course of his mostly regional loads around his native Connecticut. He happens to sit within the boundaries of a hotspot for inbound freight.

“I have come in here from Pennsylvania at $5 a mile,” he says. In such a case, “you might as well just deadhead down there and grab the load.” Truckstop.com rate averages in 2014 for flatbed inbound to Connecticut were the highest of any state in the country at $3.03. Connecticut’s also at the top for both inbound van (No. 1) and reefer (No. 2).

Explore quarterly rate changes by state displayed in heat maps for flat, dry van and reefer segments by following this link.

Explore quarterly rate changes by state displayed in heat maps for flat, dry van and reefer segments by following this link.In fact, Northeastern states dominate the inbound top 10s for all three segments. The hitch is that it’s hard to get out. “For years, guys have taken cheap freight out of here,” Bielucki says, often at “$3 a mile going in, as low as $1.50 or worse coming out.”

Bielucki goes after more lucrative local opportunities working directly with shippers. “When I go out 100 miles,” he says, “with my direct-ship freight, I can make more than $1,000 on a 200-mile turn and be eating dinner at 5 o’clock at my table and sleeping in my Sleep Number bed with my sweetie-pie. If I’m going to go further afield, I really want to make more dollars” than that.

The inbound-outbound dynamics in many Northeastern states are such that rates on outbound freight always are toward the bottom of the barrel. The lowest-10-states list for outbound freight in all segments looks a lot like the top-inbound list, with Northeastern states well represented, particularly north of Connecticut. Notably absent in low-rate lists are larger states such as New York and Pennsylvania, potential destinations for owner-operators stuck in the region without a load.

Maryland and Virginia also are not all that far away. Virginia appears on both reefer and flatbed outbound-load top 10s. “Learn your hotspots,” says Bielucki. “If I see Newport, Rhode Island, on a load on a board, I know that’s probably a military load. Rhode Island’s not good for freight or [outbound] rates, but if that military load’s been on the board a day and the next day it’s still there, odds are it will pay pretty good money.”

Conventional wisdom on the Northeast doesn’t always hold, in owner-operator Chad Boblett’s experience, which mirrors Bielucki’s local success there with flatbed. For van, “if you don’t mind the Northeast,” Boblett says, loads only going a short distance out of the region or within it could occupy a considerable amount of your time at pretty good rates. Get a “good paying load to the Northeast, and stay up there doing 150-300-mile runs, and you’ll make killer money,” he adds.

But none of the hottest states for outbound freight are in the Northeast.

In all segments, the top outbound states show contiguous areas spread across the Midwest and South. “Draw a circle around those states,” says Boblett. “This is an area where, if you stay in this area and bounce around within this area, you can make good money.”

The Midwest-South area, with Georgia and Arkansas on the Southern end up through Indiana and Illinois at the top, is “an area that I predominantly do,” he adds, typically booking as close to the pickup time as possible.

For operators farther afield from good-rate states, such as Waco, Texas-based Cody Blankenship, geography has led to different strategies, including a good bit of planning for loads outbound from low-rate areas, with negotiations taking place farther in advance of pickup. In spite of the reportedly booming spot market this past year, Texas “seemed to fall off the map in terms of availability of freight,” he says. “I used to get calls on local little 100-mile runs here and there” with his reefer. No more.

To get back from a routine haul outbound from Texas to Mississippi, Blankenship was working regularly with a broker on a run that picked up in Decatur, Ala., hauling hot wings for Papa John’s. When fuel prices fell, the broker lost the Alabama-to-Texas lane “to somebody cheaper.”

Quarterly reefer rates outbound from Texas tracked along about 10 cents below the national quarterly averages for reefer throughout the first nine months of 2014. In the final quarter, however, things changed as fuel fell. The national average reefer rate rose to $2.50 a mile from $2.46. On reefer loads outbound from Texas over that same time, rates fell a nickel on average to $2.31.

Blankenship believes there is plenty of opportunity for “owner-operators who stick it out” in areas across the country, given pressures that make it difficult for larger fleets to expand.

Truckstop.com head Moscrip sees little let-up in the strong demand that has driven the spot market since last year. Even though economic growth is fairly slow, “we certainly aren’t adding capacity to stay ahead of it,” he says. “Tight capacity has gotten rid of that cushion that shippers and brokers used to rely on. Used to be we were at about 98 percent utilization of active capacity, but we’re at 99 percent now and on our way to 100. …

“Because it’s tight, it’s really boosted rates,” Moscrip says. “For five, six, maybe even seven years, fuel prices by and large determined rates. Last year and the year before, capacity really started to determine the rate. When you look at fuel today, it’s approximately a third of the cost of running a truck. We’ve seen fuel down 30, 40, 50 percent in some places, but we haven’t seen that corresponding drop in rates as we’ve seen in the past.”

What new capacity is being added, Moscrip says, is in the small fleet and independent owner-operator realm. Larger companies are in many cases “firing customers instead of putting on a new truck. … We see a lot of new small companies coming in,” but not enough to substantially lessen the capacity pressures driving rate growth.

Blankenship, like many others, hopes that such dynamics continue to deliver “some kind of reward at the end of it.”