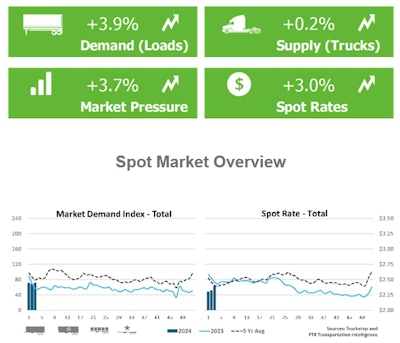

Tough winter weather across the nation delivered a spot-rates increase to owner-operators and small fleets last week, with FTR Transportation Intelligence and the Truckstop load board network reporting a 3% rise overall with mixed pictures in the major dry van, flatbed and refrigerated segments. Rates for all three, however, heated up by varying degrees as temps plummeted.

DAT Freight & Analytics saw similar dynamics, attributing the boost to shippers scrambling to move loads and contract carriers hampered by weather, necessitating a turn to brokers and owner-operators on the spot market. If the boost in spot volumes persists through this week, it could further narrow the spread between spot and contract rates averages, a signal some watchers feel shows the market turning.

Last week, DAT's monthly Truckload Volume Index illustrated the contract/spot spread for vans had narrowed again in December to 39 cents overall, with spot rates continuing to lag below the average contract move, as they have for well more than a year now. A convergence of spot and contract rates, DAT reported, would signal an end to the current cycle of falling prices for truckload services.

Averaged over the month of December, “at 39 cents, the spread between spot and contract van rates is still substantial but was down 7 cents compared to November,” said DAT Chief of Analytics Ken Adamo. Prices to move van freight rate under contract hit the lowest average in three years, he added, and spot rates gained, adding three cents. Entering 2024, while shippers were still "in a strong position as they negotiate contract rates," carriers on the spot market would be justified to "have some optimism that the market will turn.”

[Related: Trucking conditions: A big improvement in late Fall, but 2024 outlook bleak]