How much do brokers make on the loads you haul? How much do they deserve to make, and can they be trusted to honestly report the numbers?

It might just be the most heated conversation in trucking, with groups like the National Owner Operators Association outright accusing big brokers, mega carriers, and load boards and other freight-data analytics providers of either manipulating rates data, or allowing deception on the platforms. For instance, NOOA engages in frequent sparring matches with DAT Chief of Analytics Ken Adamo on Twitter (now called X) over just how much brokers are really making off their hauls.

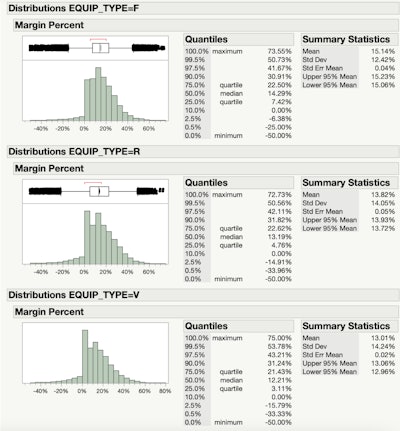

Adamo, for his part, made himself available to questions and encouraged skepticism and constructive feedback on the company’s data products. Despite this, and his rigor in sharing sources and methodology, many remain unconvinced. A recent nine-page study from Adamo looked at data submitted by DAT's customers and reported back analysis of the margins posted by brokers, as shown in the chart below. Flatbed brokers came out with the highest mean (average) margin of more than 15%, with reefer (almost 14%) and dry van (13%) following.

“When looking at margin percentages by equipment type,DAT's Ken Adamo

“When looking at margin percentages by equipment type,DAT's Ken Adamo

DAT gets the numbers from customers who become "contributors," or undergo an onboarding process where they learn to submit standardized data reporting which is "verified by both DAT and the customer to be correct," according to Adamo's study. The contributors were brokers and broker/carrier customers, and most submitted data "directly out of their TMS systems."

The paper contains a few ideas for avoiding brokers reaping a high margin from your haul.

Interestingly for the long-distance OTR crowd, the study found that "margin decreases as the length of haul increases," which Adamo attributed to fixed costs of truckers and brokers on a per-load basis amortizing over longer distances. The average margin under 250 miles sat at 15.2%. The 1,000-plus-mile haul segment sees just 11.7% average margins for brokers.