The number of loads on DAT load boards slipped 1.2% last week and truck posts increased 2% so it’s no surprise that load-to-truck ratios kept their balance:

Van LT ratio = 6.8, unchanged

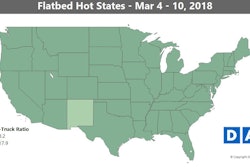

Flatbed LT ratio = 86.7, down slightly from 88.5

Reefer LT ratio = 10.1, down from 10.5

National average rates for all three equipment types were unchanged.

While the spot market may seem to be on a plateau, it’s on much higher ground compared to a year ago. Last week’s national average load-to-truck ratio was 14.1, nearly double what it was at this time last year. And spot van, flatbed, and reefer rates are well ahead of last year’s pace.

“The quarter close” upcoming this year “coincides with Easter and the start of the penalty phase for ELDs, and then we’re into the spring freight season, when the load board really starts hopping” typically, says DAT’s Peggy Dorf. Van, reefer closer looks follow:

Overall, 54 of the Top 100 van lanes were up, 41 were down, and five were unchanged.

Hot markets: Houston is the leading van market in terms of spot-volume growth in 2018. Volume jumped 4.6 percent last week and Houston to Oklahoma City—a key lane for energy-related freight—gained 22 cents to an average of $2.35/mile. Allentown, Pa., outbound volume increased 2.6 percent as final-mile retail freight activity picked up ahead of Easter. Rates spiked on Allentown lanes into Northeastern markets: Allentown to Boston was up 28 cents to $4.01/mile.