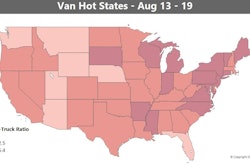

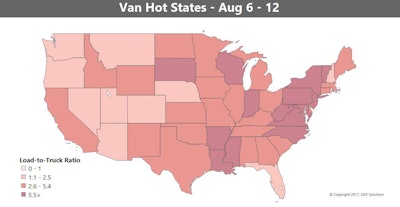

Find load-to-truck demand indicator averages for van and reefer below — for last week, when volumes declined for vans nationally but remained well higher than what is typical for August most years.

“Temperatures in our part of the woods have come down from their unseasonably torrid highs,” noted DAT’s Ken Harper, “but it’s still very warm. The same can be said about spot market freight.” In July, the national van load-to-truck ratio was 5.5 on DAT load boards. That’s “enough to count as deep red [in the van map] across the Lower 48, favoring carriers, and here we are in mid-August and it’s still a robust 4.9.”

Vans did dip in load availability last week (8 percent all told), but there’s still a lot of freight out there. National average rates lost the 3 cents per mile that they had gained in the previous week, so the national rate matches the July average again.

Vans did dip in load availability last week (8 percent all told), but there’s still a lot of freight out there. National average rates lost the 3 cents per mile that they had gained in the previous week, so the national rate matches the July average again.Hot markets: Outbound rates trended down in most major markets. The exceptions were Denver and Philadelphia, where rates edged up a couple of pennies. Denver tends to improve when rates decline everywhere else, because it’s almost entirely a “backhaul” market. The Philly area is home to some large distribution centers, as is its neighbor Allentown. Both markets got a lift as freight headed to even bigger population centers in the region.

Not so hot: Texas in general slowed down, and outbound rates dropped in Dallas and Houston. Charlotte and Atlanta also lost traction. The last to fall was Buffalo, which could mean that the back-to-school wave is already winding down for van freight – with the exception of the Philadelphia and Allentown markets, as noted above.

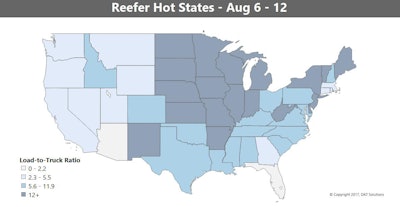

A seasonal transition is underway in produce harvests, as we head into the back-to-school season, so there is lots of demand for temp-controlled transportation. Central California is still active, and imported produce continues to be a factor at border crossings with Mexico, as well as seaports including Miami. The rest of the Southeast is pretty quiet now. Midwest reefer demand boosted, meanwhile, last week. Is it apple season yet?

A seasonal transition is underway in produce harvests, as we head into the back-to-school season, so there is lots of demand for temp-controlled transportation. Central California is still active, and imported produce continues to be a factor at border crossings with Mexico, as well as seaports including Miami. The rest of the Southeast is pretty quiet now. Midwest reefer demand boosted, meanwhile, last week. Is it apple season yet?National average reefer rates lost 4 cents per mile last week, compared to the week before, bringing that number down to the July average of $2.08 per mile. The decline is a normal seasonal trend, reflecting a change in the mix of cargo and lanes.

Hot markets: There was an increase in loads moving out of Fresno last week, which is a welcome change. Fresno had been a little disappointing until now, but it may yet produce the post-drought volumes of fruit and vegetables that many have been hoping for. McAllen, Texas, also got a boost, likely from cross-border traffic. Twin Falls, Idaho, is trending up, which usually means that a potato harvest is underway, or there’s extra demand for potatoes from storage and frozen stock, for the new school year. Outbound reefer demand also got a boost, along with rates, on some lanes leaving Grand Rapids, Mich., and Green Bay, Wis. Those trends could also be part of the back-to-school push.

Not so hot: Volume dropped last week out of Dallas; Philadelphia; Elizabeth, N.J.; and Lakeland, in Central Florida, but outbound rate trends were not consistent. For example, outbound volume dropped in the Northern New Jersey market surrounding Elizabeth, but rates rose by an average of 9 cents per mile.

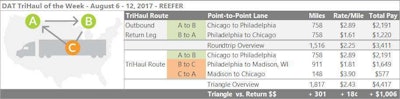

There are at least two good reasons to head to the Midwest with your reefer trailer this week: First, the region is trending up for reefer freight right now, as is well evident in the map above. Second, you’ll be well out of the path of much of the traffic associated with the upcoming eclipse if you stay in the Northeast quadrant of the country. Rates were up last week from Chicago to Philadelphia, at $2.89 per loaded mile. The return trip doesn’t pay so well, however, at only $1.61 per mile. Instead of heading straight back to the Windy City, a longer trip through/around to to Madison, Wis., could fit the bill. There’s lots of freight going in, and the outbound load-to-truck ratio for reefers in Madison is 25 loads per truck. The average rate is $1.81 from Philly to Madison — the short haul for the 150 miles back from Madison to Chicago is averaging almost $600, or $3.90 per mile. The triangle will add a day to the trip (300 loaded miles), and more $1,000 to total revenue.

There are at least two good reasons to head to the Midwest with your reefer trailer this week: First, the region is trending up for reefer freight right now, as is well evident in the map above. Second, you’ll be well out of the path of much of the traffic associated with the upcoming eclipse if you stay in the Northeast quadrant of the country. Rates were up last week from Chicago to Philadelphia, at $2.89 per loaded mile. The return trip doesn’t pay so well, however, at only $1.61 per mile. Instead of heading straight back to the Windy City, a longer trip through/around to to Madison, Wis., could fit the bill. There’s lots of freight going in, and the outbound load-to-truck ratio for reefers in Madison is 25 loads per truck. The average rate is $1.81 from Philly to Madison — the short haul for the 150 miles back from Madison to Chicago is averaging almost $600, or $3.90 per mile. The triangle will add a day to the trip (300 loaded miles), and more $1,000 to total revenue.