Previously in Matthew Patrick's two-part examination of double brokering schemes he's seen: The double brokering slow burn -- how it happens, and how to fight back against it

The commonality throughout the various pieces of the double brokering pie covered in Part 1 of this look at the issue is a lack of any real punishment for the players involved in perpetrating it or enabling it. Double brokering, if connection between carrier and broker entities engaged in these schemes can be proven, likely violates the misrepresentation prohibition in the broker regulations (49 CFR 371.7). That could be punishable in some ways, from court actions and levying of civil penalties to possible revocation of authority. Yet there is next-to-zero enforcement of that regulation.

As also noted in part 1, most bad actors (connected carrier and broker MC#s) we’ve seen are operating with virtual office addresses and, we feel, residing abroad. There is very little recourse to collect any civil penalty should it be assessed, even if the evidence is quite clear.

Who should a broker or carrier contact to share evidence of double brokering within trucking’s regulatory bodies? Common advice says the first call should be to local law enforcement. Yet does that mean local to where the load has picked up, where the actual carrier is headquartered, or where the actual broker is headquartered? These are unanswered questions, and no local law enforcement will do anything about double brokering.

Representatives within the Department of Transportation and the FMCSA have suggested reporting to the DOT Office of Inspector General. After several discussions with that very department, though, it feels fairly clear to me that nothing will be done there unless you can present them with massive fraud, multiple victims and damages -- say, $200,000 worth of nonpayment claims run up by a double broker who’s reached the “take the money and run” phase.

The OIG seems reluctant to pursue a scenario where you were double brokered a load and were paid, albeit at reduced rates. This makes sense, as the OIG has to sell these cases to state attorneys general and/or U.S. attorneys. Consider the hypothetical in part 1 of this story, where the presence of a double broker reduced the rate to the carrier by $150. That level of damages isn’t going to move the needle with a federal prosecutor. It’s yet another poor option, ultimately.

Some, including last year FMCSA's administrator herself, recommend reporting cases of double brokering to the FMCSA via its National Consumer Complaint Database. These submissions take months to be reviewed, if they are at all -- often in private, with little to no communication required to the reporting party. We fled a complaint there in December of 2022, and as of late July this year it has zero updates to it. Reps at FMCSA could not even confirm it had been viewed yet when I recently called.

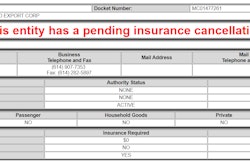

State investigative divisions that oversee insurance companies present a possible avenue. This aspect of double brokering gets very little attention. Carrier MC#s that may in reality own no trucks get set up with legitimate brokers because they have a certificate of insurance (COI) stating that they do in fact operate trucks and that those trucks are insured. Speaking with an insurance professional in late March, he said, “Anyone at any time can create a COI showing coverage on anything. They are meaningless.”

Yet the COI is the lifeblood of insurance verification in freight transactions.

Let’s say you’re a broker and want to confirm that a carrier's insurance is in fact what’s represented on the COI. You call the “insurer affording coverage” on the COI, and more often than not you’ll be told they can’t discuss the policy with you and to contact the agency responsible for issuing the cert.

We have identified several insurance agencies that are issuing COIs for carriers showing scheduled auto policies with several VINs listed, making it appear that the carrier has physical damage coverage for those units. In reality, the carrier doesn’t own/control any of those trucks. These COIs often list VINs for vehicles that are actively for sale -- easy to obtain, as many online posts of trucks for sale show a VIN. Multiple VINs on the COI might allow a nefarious carrier to obtain more loads to be double brokered, as they appear to have more than just one truck available.

We opened cases with various state investigative divisions who oversee insurance about these agencies and their actions. Perhaps unsurprisingly, even if found guilty of fraudulent practice, there is very little punishment applied to the parties involved. Certainly jail time is not in the conversation, according to the departments we’ve communicated with thus far.

To put it bluntly, tackling the double-broker frauds at government levels will take time and likely resources from industry lobbyists and large players. There’s a lot we can do together in the meantime to shut the schemes down and fight against the fraud in our industry.

[Related: Another quick-glance broker look-up tool and more ways to combat fraud, double brokering]

Red flags for carriers to look out for

- The broker posts the load as one origin/destination, yet paperwork shows the load is actually picking up or delivering to city locations nearby to those posted on the board.

- The broker asks you to check in as another carrier by name or MC# when you arrive for pickup/delivery

- The broker listed on the bill of lading (BOL) is not the one who tendered you the freight

- The broker hounds you for a photo of the BOL moments after arriving at the shipper or getting loaded.

If any of these things occur, communicate with the shipper while on-site and ask who the legitimate broker is on this load. If it’s not who you have booked the load with, ask for the shipper’s help to get in touch with the original broker.

A couple other considerations when vetting a broker:

- A broker’s website domain has only been recently purchased, yet they’re posting loads as if they’re running a steady business. We’ve seen brokers with 10-plus loads posted on boards while only having had their website domain for a week. Use readily available Whois domain lookup tools to find out any domain’s history.

- The broker has less than 1.25 years’ worth of history with authority. Many reputable brokers will not use a motor carrier until their authority has been active for six months to one year. Why aren’t carriers applying a similar standard to brokers? An Overdrive analysis of five years’ worth of newly established broker authorities and authority revocations found an average 14.5 months of life for the brokers whose authority was revoked. That could be an even better benchmark to use in insulating yourself. A broker’s authority history is easy enough to look up via FMCSA’s Licensing and Insurance public portal, as detailed at this link.

[Related: How to vet broker' credit before taking a load]

Potential red flags for brokers

Brokers need to create a protocol to identify red flags within the current carrier base, as well as newly vetted carriers. Questions to ask:

- Is the carrier domiciled at a virtual office?

- Does the carrier show any inspections in the last 24 months? While it’s possible for a very small OTR operation to go this long without an inspection, it’s nonetheless fairly uncommon.

- Does the carrier have scheduled autos on its COI with VIN numbers that lead you to vehicles posted for sale online? Does the VIN match your requirements for the load? (For instance: An apparently insured box truck owner soliciting a load requiring a full 53' trailer.) A web search of the VIN itself could tell you a lot.

- Is the carrier using an @gmail.com domain, and if so, does it match what’s listed for contact information in FMCSA’s Safer database? If not, do everything you can to verify the contact. Publicly available email services are often used by a carrier impersonators/identity thieves -- often enough, such bad actors are also executing cargo theft. The thief double-brokers the load to a legitimate carrier, claims en route that the receiver can’t take the load for a myriad of reasons, and diverts the real carrier to a different warehouse location where the freight is stolen.

- When you call the carrier, say a two-truck operation, does it sound like you’re calling a dispatch center with 15 dispatchers?

While just one of these red flags might be enough in my opinion to cease a working relationship or to prevent using a carrier, I feel many times more certain of that with any combination of these.

If you’re a broker who has been double-brokered, admit it and communicate to everyone possible about the situation. Work with the legitimate carrier who serviced the freight to leverage your resources to compile the evidence cache and get that submitted to relevant load boards, and apply pressure.

There are a handful of resources available to brokers to vet carriers, such as Highway and Carrier Assure. The Bannon Report has a newly launched platform for carriers to vet brokers, too, to help ensure they are not engaging in commerce with a known bad actor.

[Related: Closer look at owner-operator Deron Salmon's new Truck'N broker-review, nav and accounting app]

Owners looking for additional business topics, including more insight on the double-brokering issue, can find it in the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Click here to download the updated 2023 edition of the book free of charge.