President-elect Donald Trump's victory on Election Day clearly represents an inflection point in America's political and economic future, but will it boost freight rates for truckers?

The answer is complicated, but luckily there's some recent historical data we can examine: Trump was already president for four years.

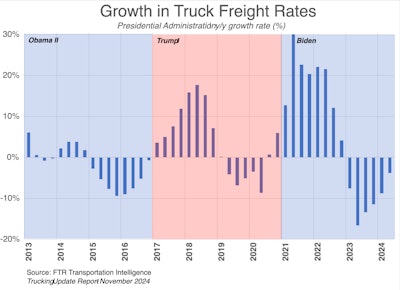

A look at spot rates (contract rates are typically higher, but lag changes in spot), shows that the Trump trucking market had an up and a down cycle pretty typical of any four year period, regardless of the president.

The second graph breaks down spot rates by equipment type and gives the dollar amount, over a 10-year period, rather than the year-over-year percentage growth rate.

The recent rates bonanza, and corresponding cost inflation over the same time period, actually reached its apex under President Joe Biden in 2021, continuing into the first part of 2022, who can forget? Though as the graph above makes clear, rates started that rising cycle under Trump midway through 2020 after an infusion of government money into the economy care of the CARES Act. And the insanity of that early-pandemic period and its almost complete shutdown of service businesses contributed, turning the American consumer towards physical goods, which needed trucking, and a lot of it.

Unfortunately, during those wild days of brokers throwing themselves at carriers, likewise accelerating digitization of the industry, the trucking market would pick up a nasty case of freight fraudsters preying on increasingly desperate businesses in a big way when costs ballooned with the 2022 fuel spike and rates started falling.

Trump has floated lots of new policy that could directly impact trucking. If Trump's idea of a 10% tariff on all foreign imports (plus boosting existing tariffs on Chinese imports) takes hold, freight markets would certainly feel the impact.

FTR Intelligence CEO Jonathan Starks and others see that as a big if, and even if it happens, another question remains: "When?"

Just because the White House expects big change in the next few months, it doesn't mean trucking should. "New administrations rarely move the needle, and definitely not quickly," said Starks. He echoed others' thoughts about the notion of swift positive economic impacts of a new administration, noting "nothing will happen immediately. We don't anticipate any real changes to market behavior until we get into Q2 [2025] at the absolute earliest."

Starks stuck to his own firm's prior forecasting, which lines up with ATBS reporting on its client owner-operators' business performance, presented with Overdrive this year at the Mid-America Trucking Show and updated just a month or so ago. Overdrive contributor Gary Buchs, too, offered similar thoughts around business-conditions improvement timing, regardless of who won the White House.

[Related: When will freight markets turn?]

"We already anticipated seeing some year-over-year gains for spot rates as we moved into the new year," Starks said. "Until we can get a sense of what the administration will actually propose (and actually do in reality), there is little to base our assumptions on" as Trump's "election promises are broad and with little in the way of specific proposals on what they would actually implement."

But if those broad tariffs actually do happen "we can safely assume that import activity will jump ahead of the implementation," similar to what happened in 2018, "and then fall off quickly," he said. Yet "to what extent and when are completely unknown."

DAT Chief of Analytics Ken Adamo pointed to one obvious change that could happen. ""The details of Trump's foreign trade and tariff policies aren't entirely clear yet," he said. "On the whole, we expect his current platform to be bullish for Mexico cross-border and bearish for ocean freight."