In the most recent monthly report from Federal Motor Carrier Safety Administration's Drug & Alcohol Clearinghouse, something historic happened -- the number of drivers in "prohibited" status actually declined.

This indicates actually a few more drivers returning to the workforce when industry watchers had speculated nearly 200,000 could be gone for good.

With freight rates stagnate, and way down from the highs of just a few years ago, some industry watchers late last year looked at the news that more than 178,000 truck drivers and other CDL holders who find themselves in “prohibited” status in the Clearinghouse would have their licenses downgraded, and their commercial driving privileges officially revoked, on Monday, November 18, as a potential sign that capacity would tighten up and bring freight rates up.

The downgrades move, which FMCSA calls Clearinghouse II, or Phase 2 of the test-results database that first launched at the beginning of 2020, gave states a 60-day deadline to officially downgrade the CDLs of any driver listed there as "prohibited." States still have until January 17 to do that for every last flagged CDL, but already there's some interesting happenings in the Clearinghouse.

Did 178,000 drivers really lose their CDL privileges?

Early analysis suggests that as few as 6,500 otherwise active truckers might actually have been meaningfully impacted by downgrades.

Avery Vise, FTR's VP of trucking, recently came to that number by comparing the number of roadside violations cited for driving while in prohibited status in the Clearinghouse to the total number of roadside inspections. "For 2022 through 2024 to date, the overall violation rate was about 0.17% -- 12,800 violations out of 7.5 million inspections over three years. Applying that percentage to FTR’s estimate of the active Class 8 population yields not quite 6,400 active drivers in prohibited status," Vise estimated.

In fact, the violation rate was less than that considering 2024 alone, so Vise said even the 6,400 might be on the high side. With more than 3 million CDL holders in the U.S., it makes sense that rates wouldn't really move.

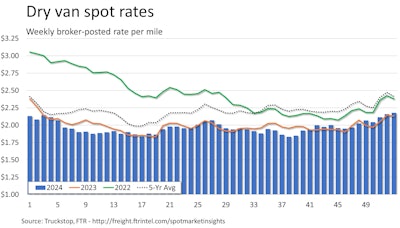

"Regarding rates, broker-posted rates are running slightly ahead of prior-year levels, but that has been true for the most part since October," Vise told Overdrive. "It’s not enough of a difference to signify an inflection in rates, and it likely would not be attributable in any meaningful sense to the regulation on CDL downgrades."

Vise cautioned that states still have 10 days to downgrade CDLs, so nothing is certain yet, and the real data could take a couple more weeks to shake out, but he wasn't expecting any big movement.

DAT Chief of Analytics Ken Adamo concurred that he hadn't seen any rates movement attributable to the downgrades.

Ultimately, Vise noted he doesn't think the impact will be "significant enough to move the market."

Yet the CDL downgrades do appear to have had a significant impact on drivers working to get out of the Clearinghouse.

"If you compare the number of drivers in prohibited status in October to November, the November number is lower for the first time in the five-year history of the Clearinghouse," said Vise.

October showed 180,110 drivers in prohibited status to November's 180,048. "There has been an increase in the last several months in the number of drivers coming out of prohibited status," Vise added, which was likely "not coincidental." State licensing authorities' warnings to CDL drivers about the downgrades probably worked, and the numbers bear that out -- in November, around 4,000 drivers in total climbed out of prohibited status through the return to duty program, when most months that number is just around 2,000, said Vise.

[Related: CBD horror story: The indignity of 'Return to Duty' and Substance Abuse Professional program]

In practice, having your CDL in prohibited status "doesn't stop the truck," Vise said. He speculated that drivers who fail a drug test might know they can't get another W-2 job or ink a new lease agreement with a carrier, as the pre-employment check would catch them. Instead, they could go another route -- getting their own authority.

"Let’s go back to 2020 or 2021," he said. "If you get put into the Clearinghouse through a random drug test or a pre-employment drug test, at that point you’re damaged goods. Theoretically, you have to either leave the industry or go through the 'return to duty' process." But it's "arguable you could go into a third path, to get your own authority -- to do that, basically lie, tell the FMCSA that you are abiding by the drug and alcohol laws' testing regulations."

In theory, the New Entrant audit would eventually catch that lie, but regulators won't get to that audit immediately. And further, Vise noted, "in the past two years only 61% of one-truck operations have been inspected, and without that inspection, there's not going to be any indication that you’re in the Clearinghouse."

So has a mass of thousands of illegally driving owner-operator authorities bowed out of the market or jumped into the return to duty process? Not really.

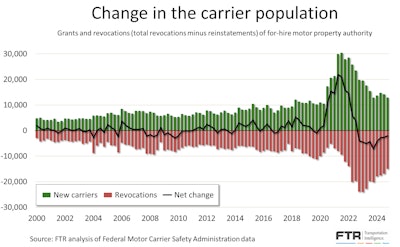

Vise said that while the number of carrier authorities are on a downward trend, "Q4 of 2024 was a very stable quarter," not indicative of some massive flight. "You had the fewest number of revocations net of reinstatement that quarter since this entire downturn began -- also had the fewest number of new entrants since Q2 2020."

In the end, Vise said he hasn't "seen any suggestion of a surge in carrier failures or anything like that."

FMCSA, reached for comment by Overdrive, said it would review the downgrades process at the conclusion of the 60-day period.

"FMCSA does not maintain state data regarding the number of drivers states have downgraded to date," an FMCSA official wrote. "FMCSA will conduct a preliminary analysis later this month to evaluate state compliance with completing the downgrades within 60 days of the November 18, 2024, compliance date."