Find a 2021-updated version of this guide via this link -- "Get your own authority: How to tackle the basics of filing, insurance, more.

Part 1 in this series looked at the advantages and disadvantages of running independent.

Establish your business entity.

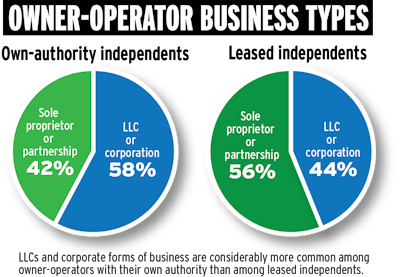

Consult with your accountant for the best business type for your operation, as all have different tax implications. Know, however, that the Limited Liability Company and various corporate forms can serve to protect personal assets in the event of an accident. Says TCRG Consulting’s Richard Wilson of the LLC form, his favored for owner-operators, “You can still be a sole proprietor, but you’re a legal business and are protected in the event of an accident.”

GETTING HELP | Many businesses specialize in helping owner-operators through the authority process – for a fee. A Web search of businesses in your area or a scan of the businesses advertising in Overdrive will yield more results.

Owner-Operator Independent Drivers Association, ooida.com | In addition to handling the federal filings, OOIDA can serve as a new entrant’s BOC-3 process agent and handle state use-tax permits and most intrastate authority applications, UCR and Heavy Highway Vehicle Use Tax (2290) filings. OOIDA’s Norita Taylor estimates a cost of $800-$900 for getting a single-truck owner-operator set up with their “one-stop shop-type package.” This includes federal filing charges and enrollment in its CMCI drug and alcohol testing consortium, but not “insurance, plates, IFTA, intrastate authority or establishing a corporation or LLC.” OOIDA membership is $45 annually.

TCRG Consulting, tcrgconsulting.com | TCRG’s Richard Wilson will handle an operator’s authority filings for $150 on top of the application fee ($300) and costs associated with BOC-3 process agents (about $100). TCRG also offers a package of compliance materials for $300 that covers required policies and associated in-office filing you’ll need to maintain in order to pass the New Entrant Audit you’ll get from FMCSA within your first 18 months of operation.