The long-tail ramifications of the COVID-19 pandemic were front and center in the first two of Overdrive's "Niche Hauls" feature reports of 2021, which probed difficulties and some new opportunities in the markedly different intermodal and auto-hauling sectors, respectively. For this third installment in that series, the picture is less decidedly mixed in terms of pandemic ramifications. In ways both direct and indirect, COVID has largely enhanced opportunity for independent owner-operators in "power only" operations. That is, hauling with motor carrier authority and without the necessity of bringing an owned trailer to the freight arrangement.

While power-only arrangements with large carrier-affiliated brokerage divisions have been common for years, non-asset brokerages and shippers such as Amazon are increasingly getting into the game as a way to more seamlessly meet freight transportation needs and deliver some of the benefits of power-only business models to contracted carriers. Those include detention reduction with drop-and-hook freight opportunities, better utilization for better profit, trailer ownership cost avoidance, and more.

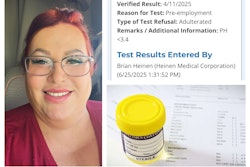

Parking ease is among the highlights owner-operator Kenyette Godhigh-Bell sees for power-only operations on layover between loads, a benefit also earmarked by a sizable number of respondents to the recent Overdrive survey around power-only benefits and drawbacks.

Parking "is one of the biggest perks" of a power-only operation, she said. Godhigh-Bell has tended to specialize in the region in and around Atlanta in recent times, hauling mostly for Amazon. The congested area's few proper truck stops are pretty well full most times of the day, and definitely in the evenings and overnight. Bobtailing after a drop at the end of her day, though, as she detailed in late November, "last night I went to Chipotle and you just park in the parking lot with two spaces. That is one of the huge benefits, for me."

Even as she spoke, she'd been sitting in Amazon's overflow lot at a facility in Eastpoint, Georgia, with other bobtails, where she had been for a 10-hour break. "I have more mobility as a bobtail," she said. "You’re not as weighed down" as with a trailer. "You can get around."

[Related: Report from a #parkingdesert]

The lot had "by default" become the no-trailer lot for owner-ops serving the facility, she added, given dearth of space all around the metro area.

This and other benefits have attracted untold numbers of other new owners to power-only systems. For some, there's an attraction similar to that of leasing, with power-only carriers getting access to dispatch personnel, big fuel discounts and more typically associated with leasing to a large carrier. There's a similar relative ease of entry without associated trailer costs, yet it's also possible to approach a power-only operation like an independent riding the spot market waves (on a long upward swell in recent times). Independents find new freedom to jump between different brokers and their digital platforms, very uncommon leased to a carrier.

All of these factors have helped seed growth in power-only programs, whether at large-carrier-affiliated brokers or not.

A quick trip by the house between loads? It's made easier without an empty trailer in tow.

A quick trip by the house between loads? It's made easier without an empty trailer in tow.

"We’ve seen strong growth for Convoy Go" since program launch in 2019, said Tito Hubert, Convoy product and engineering senior director. Growth has continued through the pandemic but front-line interest Hubert attributes less to the pandemic's supply chain-stress effects than bedrock shipper (expanded, flexible capacity) and carrier (access to preloaded trailers) benefits. At once, "we know that drop-and-hook has become even more valuable to shippers during the pandemic as it helps create efficiencies at facilities that are particularly important during labor shortages and demand surges."

With so many newer options in front of them, "from an owner-operator standpoint," said Trimble Industry Solutions Adviser Pete Covach, for some "it doesn’t make sense to own a trailer" anymore. "Being able to jump around and mix and match freight opportunities from different power-only apps gives the option and opportunity for the driver to stay loaded" with minimum interruption.

And to be more nimble between loads, as Godhigh-Bell pointed out.

Yet it's not among newer digital brokerage ops where the largest share of owners among respondents to Overdrive's recent power-only survey has gained experience. A rough third of owner-ops who've hauled power-only at any past point reported hauling in a carrier-affiliated brokerage's system.

Third-quarter 2021 earnings reports from a few of the publicly traded entities among those carriers/brokers illustrate the recent-history growth. Schneider reported its general brokerage division revenues increased 24% year-over-year "primarily due to the company’s advancement of digital capabilities and Power Only service offering growth." In a post-pandemic time period in which few large carriers grew by a substantial amount given limitations on new truck builds, among other factors, power only programs for independent haulers provide "additional capacity" to serve customers, to use Schneider's third-quarter report's language.

[Related: Small fleets in the catbird seat for growth: For-hire carrier size over the pandemic period]

Even more severe limitations on trailer builds over the same time period, partially a result of the pandemic's supply chain effects, have served to bring those small carriers to where the trailers are, too. In its Q3 earnings report, Knight-Swift trumpeted its "fleet of over 60,000 trailers" as key attraction to continued growth in its large brokerage division.

Large owner-operator fleet Landstar, further, highlighted new changes to its classification of truck services and equipment type with its Q3 earnings release. For the first time the company broke out "power-only, expedited, straight truck, cargo van and miscellaneous other truck transportation services" in a category all its own for its brokerage services. That followed hugely increased demand for all of those types of operations, the company said – a 92% increase in total revenue obtained in Q3 2021 versus the same quarter in 2020.

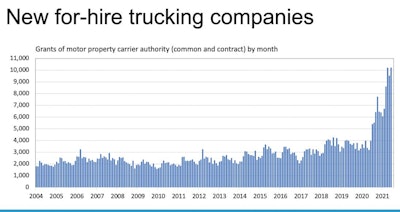

Adam Wingfield, head of the Charlotte, North Carolina-headquartered Innovative Logistics Group owner-op and small fleet consultancy and a former owner-operator himself, believes a large percentage of new carrier authorities filed since strict COVID lockdowns let up in summer 2020 are likely to be power-only independent carriers today. "We're talking about anywhere between 80,000 and 100,000 single-truck power only carriers," he said, as a "safe assumption to make," part of the reason for the demand pressure on trailer builds. "The squeeze right now is on the availability of trailers – and the premium that it’s going to cost to get into one of those trailers."

The explosion of new carrier authorities over the pandemic period is evident in this chart from FTR Transportation Intelligence, showing monthly numbers from federal data through June of 2021. High monthly numbers have continued since then, noted Adam Wingfield of Innovative Logistics Group. "Since July of 2020," he said in November this year, "more than 130,000 have gone active." In the month of October alone, that included "10,000 plus new authorities."

The explosion of new carrier authorities over the pandemic period is evident in this chart from FTR Transportation Intelligence, showing monthly numbers from federal data through June of 2021. High monthly numbers have continued since then, noted Adam Wingfield of Innovative Logistics Group. "Since July of 2020," he said in November this year, "more than 130,000 have gone active." In the month of October alone, that included "10,000 plus new authorities."

[Related: Components delays plague trailer production, other news]

Frank Maly, director of commercial vehicle transportation analysis and research at ACT, underscored that analysis. Maly said ACT had seen some new industry production capacity under development late in 2021, yet trailer "OEMs remain reticent to fully open their 2022 order-boards. We expect them to carefully manage their order acceptance over the next few quarters, as they continue to face unusually long backlog-to-build ratios.”

Price increases, meanwhile, flow through the trailer build supply chain to the end user. “Many OEMs have had to re-negotiate pricing on previously accepted orders with fleets," Maly said, "implementing either price changes or material surcharges during the year. Sometimes, given their extended backlogs, OEMs returned to their customers more than once for these adjustments, additional reasons for manufacturers’ current caution.”

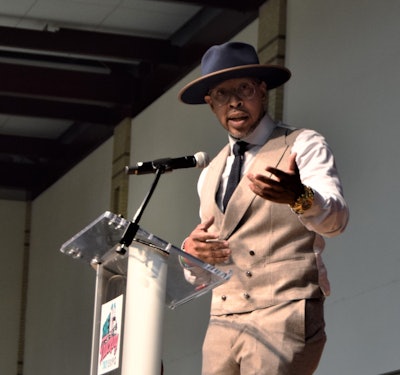

Adam Wingfield of Innovative Logistics Group, pictured on the stage during his talk at the September SHE Trucking Expo.

Adam Wingfield of Innovative Logistics Group, pictured on the stage during his talk at the September SHE Trucking Expo.

From a high level, Wingfield sees power-only as a way for big fleets to "facilitate more capacity" for their customers with outside carriers putting the fleets' large trailer pools to work. "It’s a model that’s growing this year," he reiterated.

Traditionally-non-asset-based brokerages increasingly offer power-only opportunities to partner carriers, too. Large broker C.H. Robinson is among them with its Power+ (or "power plus") program, in which participating carriers dedicate capacity to a single or multiple entities among the broker's shipper customers.

"We’ve had some form of power only for decades," said C.H. Robinson North American Surface Transportation President Mac Pinkerton. Typically, past forms were associated with unique Robinson customer situations, where a short-term drop-and-hook arrangement filled a particular need. About five years ago, the company launched Power+, starting out with "one significant customer," Pinkerton added. Yet attracting customers to it and carriers to participate for reliable freight from "multiple customers in a lane or a geography" wasn't in the cards immediately.

Pinkerton and company drew the Power+ footprint down and "then started to rebuild it," he said, with that kind of expansion in mind.

The explosion in numbers of new small carriers with authority over the course of the pandemic, along with ballooning shipper interest in power only, has made much more possible, Pinkerton said. Looking back over the 12 months ending in November 2021, "carriers participating in that program have doubled. Shipments moved inside of Power+ have tripled" over the same time period. Once, C.H. Robinson's power-only loads were very few and far between. Now, Pinkerton estimates "high single digits" for a percentage of total loads moved, and that's not including port and other container drays, sometimes categorized by freight businesses under the "power only" moniker.

The phenomenon driving all that power-only growth is a pandemic-inspired boost in demand for what Pinkerton called "supply and demand engineering. ... We had the pre-COVID challenges in our industry": required electronic logging devices and the hours of service limiting capacity in new ways, "unique situations with baby boomers" retiring, and more. "Then – bam! – the pandemic really exacerbated those things."

With rates for freight on the rise all around, the attractiveness of going independent for leased owner-operators went through the roof. "We're seeing a big transition from being part of a private fleet or leased to a larger company to that owner-operator space," Pinkerton said.

[Related: 'Driver shortage claims miss self-employment explosion]

Power-only programs like Power+ and so many others become a refuge for owners like Godhigh-Bell, whose maiden voyage hauling with authority this year came at a massive cost for liability insurance as a new carrier, cutting into what money she might have put into buying a trailer. Reduction in detention with trailers loaded and ready to go upon arrival allows for owner-ops with close freight partners to maximize productivity outside the usual hurry-up-and-wait dynamics that live-load-and-unload situations can come with. "Your ability to maximize productivity can be a huge challenge," as Pinkerton put it.

Trimble Industry Solutions Adviser Pete Covach notes his company has made big strides in integrating trailer tracking devices from a variety of electronics/comms providers to be interoperable within a single transportation management software (TMS) system for shippers and other parties implementing power-only solutions. Such solutions address a pain point for owner-operators, too, reducing the app overload so many have felt hauling with multiple brokers and/or shippers. "Bringing things back into that singular view" for any shipper allows visibility into where the freight is, ultimately, without any necessity to bother the power-only carrier with downloading this or that tracking app, Covach said.

As operations get more and more sophisticated, it's a 1 + 1 = 3 sort of situation for all parties, said Pinkerton. "If you can give that driver access to a drop-and-hook, it maximizes hours utilization and maximizes yield on the assets. For the customer – it improves flexibility, and sitting underneath that is the technology capability to give them visibility into that freight" as it's moved. "That's where scale matters, and the technology to support that scale. ... The opportunities were building pre-pandemic," but COVID-inspired supply-chain pressures fast-tracked them.

It's not just the legions of new carriers with authority who are benefiting.

Wayne Timmons, co-owner with his brother of Arkansas-based Timmons Transit, attributes much of the growth the fleet has experienced since 2016 to involvement in Robinson's Power+ program. Timmons' father was trucking when Timmons was a teenager with an oilfield specialized company. "I grew up not liking trucking very much," Timmons said, on account. "I saw it as a rough and rowdy business. I said we'd never be in trucking. Well, be careful what you say."

Wayne (left) and Shane Timmons of Arkansas-headquartered Timmons Transit. The company also has a terminal in Dallas, Texas.

Wayne (left) and Shane Timmons of Arkansas-headquartered Timmons Transit. The company also has a terminal in Dallas, Texas.

By the late 1990s, Timmons and his brother were full-time small fleet owners hauling freight, with a focus principally on acquiring direct customers. In 2016, Timmons was working to anticipate the coming ELD mandate, as "everybody was trying to find a better way to truck," he said. In collaboration with a large customer of C.H. Robinson's, Timmons Transit moved into the Power+ program in its very early days.

"Through the course of that we rolled into several other projects" inside the Power+ system, Timmons said, allowing the company to "come in and work a lane or two out of a customer that demands one trailer pool," rather than several from different small carriers. Serving its own customer needs for drop-hook solutions that way at the time was difficult for Timmons given limited trailer assets itself. "There are a lot of assets tied up with those trailers" sitting at either end of a lane, he added.

Several Power+ projects, too, involve customers that are "large enough that they normally wouldn't work with a carrier our size," he said. "They want somebody to come in and handle 90 to 100% of their freight." C.H. Robinson has been able with such customers to be the single touch point marshaling the forces of several smaller carriers to do just that.

Early on in their participation in the program, Timmons Transit stood at about 40-50 trucks, though they've grown considerably in five years to 150 trucks and around 600 owned trailers, around 40-50 of which are in the Power+ pool themselves. "There's no denying the fact that it gave us a large opportunity for growth" since 2016, he said, estimating now that his mostly leased owner-operator fleet (60%, compared to 40% company trucks) is carrying 20-30 Power+ loads behind its tractors on any given day. Many run intrastate in Texas, or Texas to Oklahoma and back, including some short hauls with multiple trips daily.

All freight Timmons pulls through Power+, as with many (though not all) power-only operations, run in dry vans. Pinkerton noted vans are roughly 70% of the Power+ system, with flatbed and reefer accounting for the remaining 30%.

Timmons does do limited flatbed work with around 10 owned trailers, too. Owner-operators at the fleet are paid based on miles, by and large, though around 10% of them run under percentage pay contracts on more challenging, multiple-stop hauls or with other specialized freight. --Alex Lockie contributed to this report

Next in this series: Power-only pros: Chief benefits of no-trailer systems include factors that ease process of scaling up

Associated podcast: 'Power only' as a springboard for owner-operator growth: Tim DeWitt's 34-truck fleet

Read more in the long-running "Niche Hauls" series via this link.