Previously in this series: How brokers, carriers can prevent business ID theft schemes

Too many truckers coming in green to operate with authority don’t really understand the broker relationship, says owner-operator Rico Muhammad of Atlanta. When you agree to haul a load for a broker, “you are extending credit to that broker, and you have to vet these guys,” he says. “If you’re not vetting them and you get stuck with the load” with no compensation, “there isn’t anybody to call to help you.”

If you’re considering first-time business with a broker, call your factoring company, recommends independent Rico Muhammad. “If a long-established reputable factoring company won’t touch them, odds are you shouldn’t either,” he says.

If you’re considering first-time business with a broker, call your factoring company, recommends independent Rico Muhammad. “If a long-established reputable factoring company won’t touch them, odds are you shouldn’t either,” he says.Established independents such as Muhammad can employ a simple approach to avoid getting scammed by bad brokers. He’s got direct freight partners that fill his two trucks’ reefer trailers on his principal lane from Atlanta up into North Carolina. For trips when he needs a brokered load, he relies on a few longtime brokers that he trusts, including the Allen Lund Company and Choptank Transport.

There were years when he relied more on load boards and, often enough, a broker he had no previous relationship with. Today, “I don’t hardly have any use for a load board,” he says.

If your operation hasn’t matured to that level of stability, however, there are tools to assist in screening brokers before agreeing to a brokered load as well as to report improper broker behavior and get part, if not all, of what you’re owed. Steps in the most basic approach for seeking payment – filing against a broker’s bond or trust – are well-known and available via this link. Following are other avenues for vetting brokers and then dealing with those who don’t pay you.

CHECK BROKER CREDIT

Ways to check broker credit are more numerous and accessible than ever, including via days-to-pay information and other services from major load boards Truckstop.com and DAT.

When he wants to check a broker’s credit, “I look at DAT,” says owner-operator Chad Boblett, of Lexington, Kentucky. “Almost all brokers are on DAT, and if they’re not, then I want to know why they’re not. The DAT directory will tell you whether [partner factoring company Triumph Business Capital] will factor the broker or not. If they won’t factor,” odds are the broker’s credit rating is too unreliable for the factor to agree to collecting for you.

Muhammad uses Orange Commercial Credit factoring company in the rare occasion he’s considering a load from an unfamiliar broker. “First thing, if you haven’t done business with the broker, call your factoring company,” he says. If a long-established reputable factoring company won’t touch them, you shouldn’t either.

Sometimes, though, depending on the situation, it may make sense to take a chance on a newer broker who doesn’t have enough credit history for big factoring companies to be comfortable with. In such rare cases, Boblett says, “I read the reviews” they may have received on the load boards. DAT and Truckstop.com offer review opportunities for any business entity using the service. Such could be helpful in pre-checks of brokers and, likewise, alerting both board personnel and fellow truckers to fraud-in-progress.

With newer brokers, Muhammad says, he might see if they have a quick-pay option, often roughly equivalent to a factoring fee of 3% to 5%. “It may be worth taking the hit on the quick-pay just to make sure you get paid quickly.”

In the days before identity thieves were plying the old fuel-advance scam, “some of the old hands used to say get a fuel advance — that way you’ll get at least some of the money out of the load” if things go sour, Muhammad adds.

Others advise totally avoiding brokers who lack considerable history in business. After all, it’s the same caution many brokers use in dealing with young, independent owner-operator businesses.

“Most reputable brokers will not use a motor carrier until their numbers are active for six months to one year,” says former independent Joe Rajkovacz, today working for the Western States Trucking Association. “Guys,” Rajkovacz asks owner-operators, “why would you use a broker that doesn’t meet those same requirements?”

Or that doesn’t beat those standards. Of the more than 8,000 brokers who had their authority revoked for failure to maintain adequate surety or a BOC3 process agent between 2015 and 2019, Overdrive computed their average time in business was 14.5 months. That could be an even better benchmark to use in insulating yourself from payment shorting.

You can find a broker’s authority history via private services such as Truckstop.com’s CreditStop products and the DAT Directory. It’s also easy enough to look up the information via freely available government websites, as detailed at this link.

Chad Boblett’s Rate Per Mile Masters Facebook group is a key forum for owner-operators and brokers to discuss existing and evolving scams. Boblett says a broker member points to an apparent scam coming from carriers with sizable pools of independent freight agents and subagents working under their authority, as well as having owned or leased trucks. Carriers in such situations might try to get away with double-brokering, putting too many hands in the cookie jar of the overall freight rate. While such rate fleecing has gone on for years, Boblett believes it’s not exactly “the wild, wild West out there anymore,” thanks to the fluid communications among the players made possible by his Facebook group and other forums.

Chad Boblett’s Rate Per Mile Masters Facebook group is a key forum for owner-operators and brokers to discuss existing and evolving scams. Boblett says a broker member points to an apparent scam coming from carriers with sizable pools of independent freight agents and subagents working under their authority, as well as having owned or leased trucks. Carriers in such situations might try to get away with double-brokering, putting too many hands in the cookie jar of the overall freight rate. While such rate fleecing has gone on for years, Boblett believes it’s not exactly “the wild, wild West out there anymore,” thanks to the fluid communications among the players made possible by his Facebook group and other forums.Boblett emphasizes one bedrock principal: Don’t take at face value what any person says or writes if you don’t know the person well. Take the time to research your contact’s business to see whether they really are who they say they are. It’s too often a principle that’s learned only by experience, unfortunately.

In the Rate Per Mile Masters Facebook group, which Boblett administers, he says, “Every time one of these scams pop up” where an owner-operator gets taken, he asks for detailed information about the member’s efforts to vet the broker: “Did you do this, did you do that? Usually, the answer is no.”

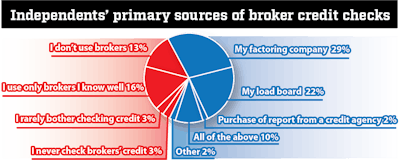

Factoring companies, using their relationships with credit bureaus and their own internal information, have become the No. 1 choice for independent owner-operators checking broker credit.

Factoring companies, using their relationships with credit bureaus and their own internal information, have become the No. 1 choice for independent owner-operators checking broker credit.DO ALIAS SEARCH ON QUESTIONABLE BROKERS

The DAT Directory, accessible by any DAT customer, contains what security specialist Tami Hart calls an “alias search” that can be performed on any entity. Brokers can vet carriers via the tool, but the opposite also is true. “If they see this broker and want to see if others are linked to that — a phone number, ZIP code, an address or a company name,” the search tool looks for multiple entities for any of those data points.

If there’s possibly fraudulent intent, such as a “business shown to be operating in seven locations, and the connection between them makes no sense,” says TBS Factoring Service President Jennifer Licktieg, “we put them on our do-not-factor list.” TBS does the same if there is evidence linking an entity to other authorities that had very short histories before being revoked.

Via the TBS mobile app, owner-operator clients might see a do-not-factor determination on a certain broker. That’s the “strongest recommendation to our clients that they ought to steer clear” of contracting with the company, Licktieg says.

Next in this series: How to report — or threaten to report — bad brokers, take action for payment recourse